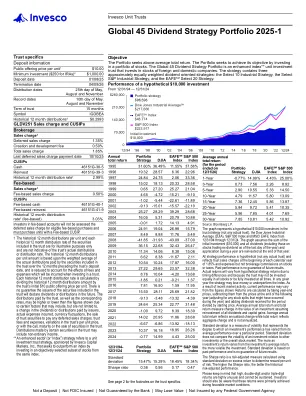

Let's take a visual walk around the figure above and see how the key indicators work. First, notice that when you are piloting your product for innovators in the lower-left quadrant 1, the business is in negative cash flow. The total resources invested in the product to date exceed the return. The market growth rate should be low because it is still defining the problem and the solution for the market. Therefore, the competitors within its defined niche should be few in both number and capabilities. Consequently, the pricing pressure will be high because the business has not fully defined the problem or proven its solution, so it has no real leverage to charge enough money for it at this stage and funding must come from external sources, either investors or proceeds from another business unit).

Mastering Lifecycle Strategy | Organizational Physics

![[在线双语] HEA Corporate Strategy 23-26](/simg/6/640135e75854f1ba6fd4b01ecd8877c84d7f37fc.webp)